From Jason Gardner, Utah State Tax Commission

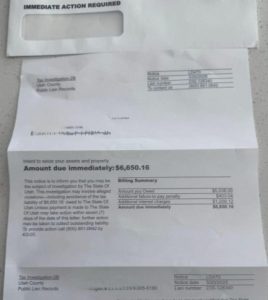

SALT LAKE CITY (April 4, 2025) – The Utah State Tax Commission is warning taxpayers about a fraudulent letter circulating in Utah that falsely claims the recipient owes unpaid state taxes. The letter, designed to resemble an official government notice, threatens legal action, liens, or asset seizure if immediate payment is not made.

These deceptive tactics are commonly used by scammers to pressure individuals into making payments without verifying the legitimacy of the claim.

How to Protect Yourself:

- Verify before paying – If you receive a suspicious tax notice, contact the Utah State Tax Commission directly at 801-297-2200 to confirm its authenticity.

- Do not respond to the letter – Avoid calling any phone numbers or visiting any websites listed in the fraudulent notice.

- Report the scam – If you receive a fraudulent tax notice, report it to the Utah State Tax Commission at tax.utah.gov/contact.

Scammers frequently increase their activity during tax season, exploiting taxpayers’ concerns about penalties and legal action. The Utah State Tax Commission urges all Utahns to remain cautious and contact the agency with any concerns regarding tax-related correspondence.

For more information, visit tax.utah.gov.